- #Does fuel expense go on statement of cashflows how to#

- #Does fuel expense go on statement of cashflows full#

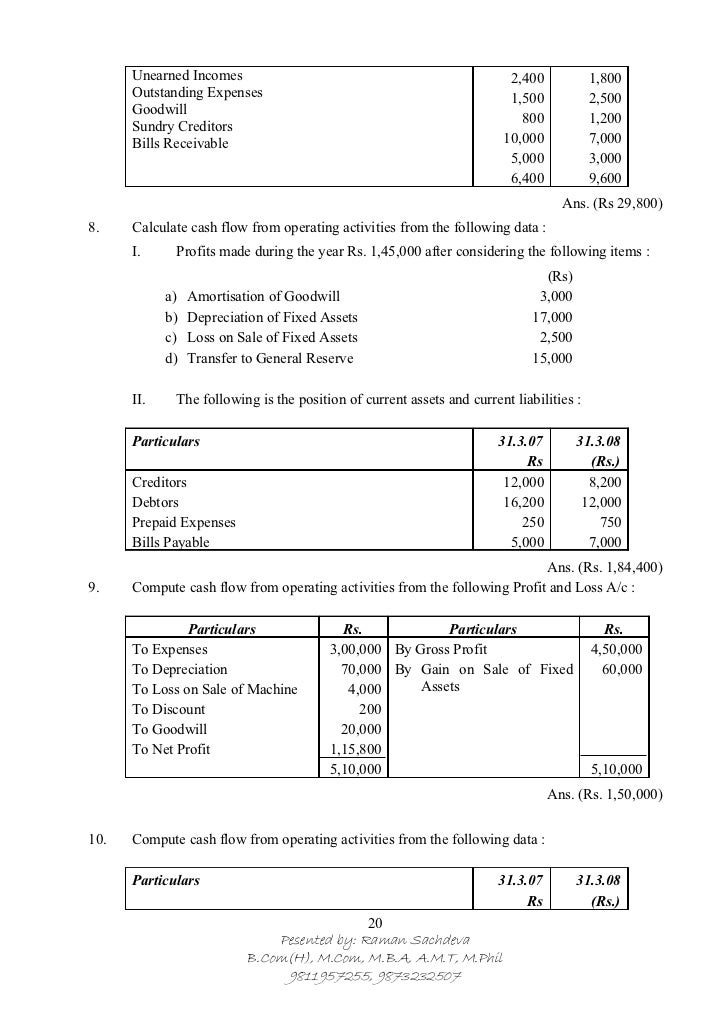

Maintaining a positive cash flow in your small business is essential to gaining profit. Maintain Positive Cash Flow in Your Business In order to grow your business, you’ll need cash to reinvest (buying new equipment, advertising costs, investing in new projects), as you cover operating costs and liabilities.Ī great way to manage your cash flow is to have accounting frameworks in place that give you clear insight into your cash inflow vs outflow.Īvoiding a negative cash flow will allow you to make wiser business decisions. More than just staying positive, a strong business will have a focus on growing. What Affects Cash Flow?Ī positive cash flow keeps your business afloat, managing a positive cash flow will ensure that you’re always earning more than you’re spending. In contrast, if your business is spending more than your income, you have negative cash flows. When your business is bringing in more profit than it is spending, you have positive cash flows. Avoid unnecessary financing activities that may disrupt your flow or set your business back. Wise financing decisions that allow you to invest in better equipment or work with affiliated entities can definitely give your company a leg up. Financingįinancing is a broad term that can both help and hurt your business. Current assets such as intangible assets, stock in legible entities, and future contracts can all be valuable resources to keep a steady and growing cash flow. There are many different types of investment that will benefit your business.

InvestingĪn excellent way to keep a positive cash flow for your business is to invest. Costly resources such as rent, inventory, and raw material expenses used for operational purposes all add up to eat away at your cash budget. One of the biggest hurdles in keeping a positive cash flow is the costs of keeping operations going.

#Does fuel expense go on statement of cashflows full#

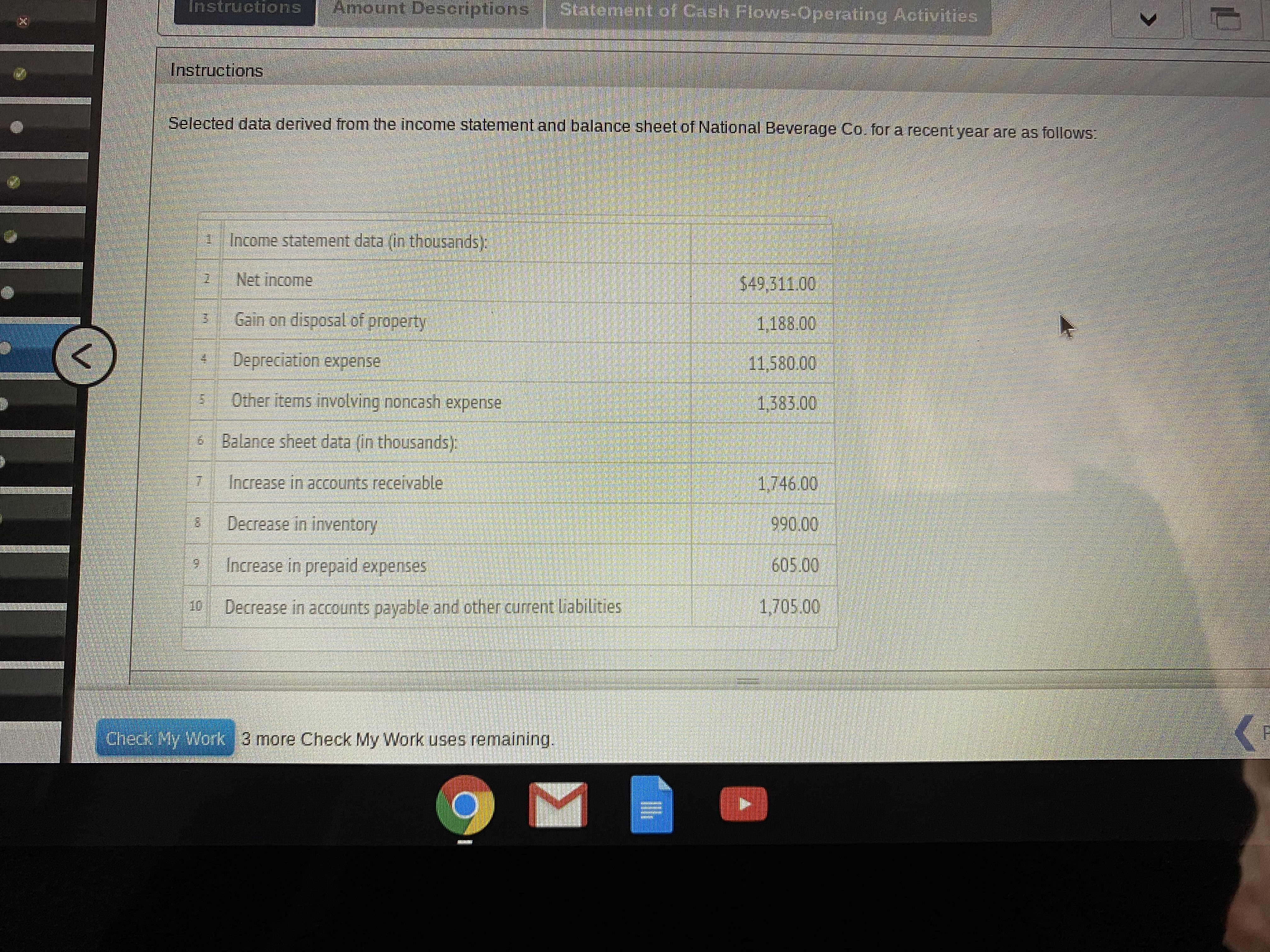

Cash flow is the broad term representing the full amount of both income and expenses of your business so it does not necessarily determine your profit.Ĭash flows in and out support three different types of business activities: Operating, Investing, and Financing. It’s easy to mix up cash flow with profit and working capital, so it’s important to distinguish the difference. So, what is cash flow?Ĭash flow is the total amount of income flowing in and out of your business. Navigating your expenses by keeping an account of business cash flows is key to a smooth accounting process. There are many elements that go into managing the books for your business. More Resources on Cash Flow Business Cash Flow & Why it Matters Understand the Essentials of Cash Flow Management

#Does fuel expense go on statement of cashflows how to#

Maintain Positive Cash Flow in Your BusinessĬash Inflow vs Outflow & How to Calculate It Cash Inflow vs Outflow & How to Calculate It.This article will give you insight on the differences between cash inflow and cash outflow, and how to manage both for your small business. A better understanding of cash flow will help you navigate your business finances with confidence.

0 kommentar(er)

0 kommentar(er)